I Love Bitcoin’s Volatility (2014)

Naysayers always complain:

“Bitcoin is too volatile! Nobody will ever use something so volatile!”

That’s superficial and short-sighted.

Volatility is not a property inherent in Bitcoin itself.

It is caused by the way people treat the asset - a function of people’s attitudes and behaviors.

Unless Bitcoin becomes heavily manipulated or human nature changes, a new monetary asset that regularly grows in both popularity and usefulness will always be volatile.

To complain that nobody will use Bitcoin because it’s volatile is to say

“Bitcoin’s adoption rate is so astonishingly fast that it will never be popular!“

If Bitcoin were less volatile, would it have an even more rapid adoption rate?

Bitcoin’s price has to go up as more people start using it, and if a lot of new people start using it, then it has to go up fast (that is, be volatile).

Volatility vs. Liquidity

Liquidity: a large amount can be bought or sold without significantly altering the price.

Volatility: the degree and rapidity of price changes, independent of the volume of trade.

The liquidity of a currency limits the size and volume of purchases that can be made with it. If you could not buy/sell a house’s worth of bitcoins without significantly altering its price, then you could not purchase a house with bitcoins.

A currency can be both volatile and liquid.

It is liquid if one person can buy a lot without affecting the price.

If lots of people all try to buy a lot at the same time, then it will still be volatile.

Bitcoin will never have a stable price.

Unlike everything else, a higher price for Bitcoin does not reduce its utility - you just trade with smaller amounts.

In fact, a higher price makes it more useful because more people want to use it.

There is no reason to think that Bitcoin will stabilize in terms of other currencies. Once Bitcoin starts killing the other currencies, it will still be volatile, which will still indicate its success.

Unit of Account

Money is often simultaneously a:

store of value

medium of exchange

unit of account

Bitcoin’s volatility is only set to grow as it enters hypermonetization and other currencies are demonetized. This temporarily makes it less useful as a unit of account, but that’s part of the course.

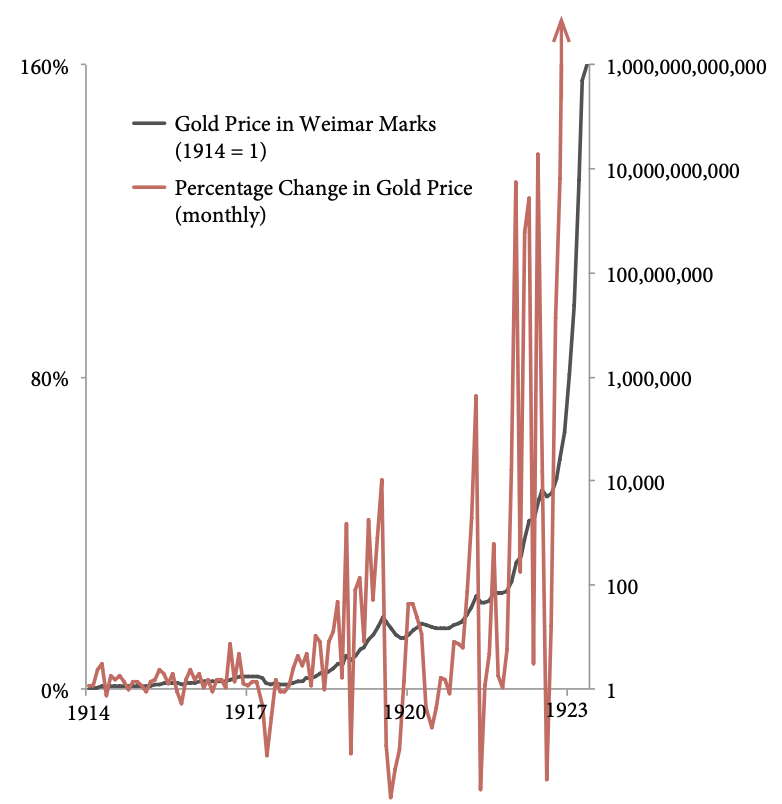

Gold was similarly volatile during the Weimar hyperinflation.

It is still excellent as a store of value and a medium of exchange, which are good enough reasons to buy into it.

In the relatively near future, there may come a time when no real unit of account is available. That’s fine.

Those who worry about Bitcoin’s volatility fail to understand what it actually means for Bitcoin.

originally posted for 2 minute bitcoin https://www.2minutebitcoin.org in https://www.2minutebitcoin.org/blog/i-love-bitcoins-volatility-2014

Original Author: Daniel Krawisz

Original Word Count: 1261

Original Posted Date: January 28, 2014

Original Source: https://themisescircle.org/blog/2014/01/28/i-love-bitcoins-volatility/

In the digital age, things happen gradually, then suddenly fast. Hyperinflation, bank runs and crises all unravel at the speed of light. Bitcoin exists as a life raft - the solution to the money problem that is global QE.